What is Ken Lewis’s net worth and salary?

Ken Lewis is an American businessman who has a net worth of $75 million. Ken Lewis is best known for leading Bank of America through one of the most aggressive expansion periods in modern financial history and then steering the institution through the 2008 global financial crisis. Rising from a middle-class background to the top of the U.S. banking system, Lewis spent nearly four decades at Bank of America, ultimately serving as chairman and chief executive officer. His tenure was defined by transformative acquisitions, most notably Countrywide Financial and Merrill Lynch, which dramatically reshaped the bank’s size, scope, and risk profile.

At his peak, Lewis ran the largest consumer bank in the United States, overseeing trillions of dollars in assets and tens of thousands of employees worldwide. His leadership style emphasized scale, cross-selling, and national dominance, a strategy that paid off during the credit boom but left Bank of America deeply exposed when the housing market collapsed. While Lewis is credited with helping prevent a total financial system breakdown by absorbing Merrill Lynch during the crisis, his legacy remains controversial due to massive losses, shareholder lawsuits, and regulatory scrutiny that followed. Few executives are as closely associated with both the ambition and the excesses of pre-crisis American banking.

Salary

During his tenure as chairman and CEO of Bank of America, Ken Lewis’s compensation followed a traditional large-bank structure built around base salary, cash bonuses, and equity awards. For much of his final years in the role, his base salary remained relatively steady at approximately $1.5 million per year, with total compensation fluctuating sharply based on stock grants and performance incentives.

In 2002, Lewis earned total compensation of roughly $18.4 million, including nearly $6.9 million in cash and about $11.3 million in equity awards. His pay dipped in 2004, when total compensation came in around $7.4 million, before rising again during the height of the credit boom. In 2007, just before the financial crisis, his total compensation peaked at approximately $20.4 million. As the crisis unfolded in 2008, his pay was sharply reduced, falling to about $9 million, a decline of more than 50%.

In 2009, amid intense public and political scrutiny, Lewis waived his salary and bonus entirely. His reported compensation that year was just over $32,000 and reflected only perks such as security and administrative benefits. Despite that symbolic cut, Lewis’s long-term retirement benefits were substantial. Upon his departure, his pension alone was estimated at roughly $53.2 million, with his total retirement package valued between $73 million and $135 million once deferred compensation and insurance benefits were included. The size of that package became a focal point in broader debates about executive pay in the wake of the financial crisis.

Early Life and Education

Kenneth Douglas Lewis was born on October 26, 1946, in North Carolina. He was raised in a modest household and worked a series of blue-collar jobs while attending school. Lewis earned his undergraduate degree from the University of Florida and later completed an MBA at Rollins College in Florida. Unlike many Wall Street executives of his era, he did not begin his career in investment banking or elite financial circles.

Lewis joined North Carolina National Bank, a predecessor to Bank of America, in 1969 as a credit analyst. That entry-level role marked the beginning of a long, steady climb inside one institution, a rarity among top banking executives.

Rise Through Bank of America

Over the following decades, Lewis built a reputation as a disciplined operator with deep knowledge of consumer banking. He held a variety of management roles across retail banking, credit operations, and regional leadership. When Bank of America merged with NationsBank in 1998, Lewis emerged as one of the most powerful executives in the combined entity.

In 2001, Lewis was named chief executive officer of Bank of America. He later added the chairman title, consolidating control at a time when the banking industry was rapidly consolidating and expanding into new lines of business.

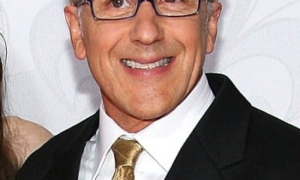

Getty Images

Expansion Through Acquisitions

Lewis pursued an aggressive growth strategy centered on scale. Under his leadership, Bank of America acquired FleetBoston Financial, MBNA, LaSalle Bank, and U.S. Trust, dramatically expanding its geographic reach and consumer footprint. These deals transformed Bank of America into a coast-to-coast financial institution with dominance in credit cards, mortgages, and retail banking.

The strategy reached its apex in 2008 when Lewis agreed to acquire Countrywide Financial, the nation’s largest mortgage lender, at the height of the housing collapse. The deal gave Bank of America an enormous mortgage servicing platform but also saddled it with billions of dollars in toxic loans and legal liabilities.

The Merrill Lynch Deal and Financial Crisis

Lewis’s most consequential decision came in September 2008, when Bank of America agreed to acquire Merrill Lynch during the height of the financial panic. The acquisition was brokered with encouragement from U.S. regulators, who feared that Merrill’s collapse would further destabilize the financial system.

While the deal helped avert a broader meltdown, it proved disastrous for Bank of America shareholders in the short term. Merrill Lynch reported massive losses tied to subprime mortgage exposure, forcing Bank of America to accept tens of billions of dollars in federal assistance through the Troubled Asset Relief Program. Lewis later faced intense criticism for proceeding with the acquisition and for initially withholding the scale of Merrill’s losses from shareholders.

Government Scrutiny and Legal Fallout

In the years following the crisis, Lewis became a focal point of congressional hearings, regulatory investigations, and shareholder lawsuits. Critics accused him of misleading investors and failing to adequately assess the risks of the Merrill Lynch deal. Bank of America ultimately paid billions in settlements related to mortgage practices and disclosure failures tied to acquisitions made under Lewis’s leadership.

Although Lewis avoided personal criminal charges, his reputation was significantly damaged. He relinquished the chairman role in 2009 and stepped down as CEO at the end of that year, closing a 40-year career at the bank.

Later Years and Legacy

After leaving Bank of America, Lewis largely retreated from public life. He served on a limited number of corporate and nonprofit boards but did not return to frontline financial leadership. His tenure remains a central case study in modern banking history, frequently cited in discussions about executive power, risk management, and regulatory oversight.

Ken Lewis’s legacy is inseparable from the 2008 financial crisis. He built Bank of America into an unprecedented consumer banking giant and then pushed it into deals that nearly overwhelmed the institution. Whether viewed as a bold consolidator who helped stabilize the system or as an executive whose ambition magnified systemic risk, Lewis remains one of the most consequential banking CEOs of his generation.

Real Estate

Ken Lewis’s real estate holdings were most closely associated with Charlotte, North Carolina, the longtime headquarters of Bank of America. In 2003, Lewis and his wife Donna purchased an approximately 8,500-square-foot mansion in the gated Morrocroft neighborhood of SouthPark for $1.7 million. The property, which featured luxury finishes and extensive grounds, became his primary residence during the final years of his tenure at the bank.

After Lewis stepped down as CEO, the Morrocroft home was listed in early 2010 for $4.5 million. The listing price drew attention at a time when Lewis was under public scrutiny, and after several price reductions and months on the market, the property ultimately sold in May 2010 for $3.15 million, still representing a significant gain over the original purchase price.

Around the same period, Lewis also listed a vacation home in Hilton Head, South Carolina. While fewer details were publicly disclosed about that sale, it reinforced the sense that Lewis was simplifying his real estate footprint following his exit from Bank of America. After selling the Morrocroft mansion, Lewis and his wife reportedly remained in the Charlotte area but relocated to a different neighborhood, maintaining ties to the city where he had spent nearly his entire professional life.

All net worths are calculated using data drawn from public sources. When provided, we also incorporate private tips and feedback received from the celebrities or their representatives. While we work diligently to ensure that our numbers are as accurate as possible, unless otherwise indicated they are only estimates. We welcome all corrections and feedback using the button below.