Topics

What is a Credit Score I CIBIL Score I 2023!

A credit score is a three-digit number, usually between 300 and 850, designed to represent your credit risk, or probability of paying your bills on time.

Credit scores are calculated using the information on your credit reports, including your payment history, the amount of debt you have, and the length of your credit history.

Higher scores mean that you have demonstrated responsible credit behavior in the past, which can make potential lenders and creditors more confident when evaluating a credit application.

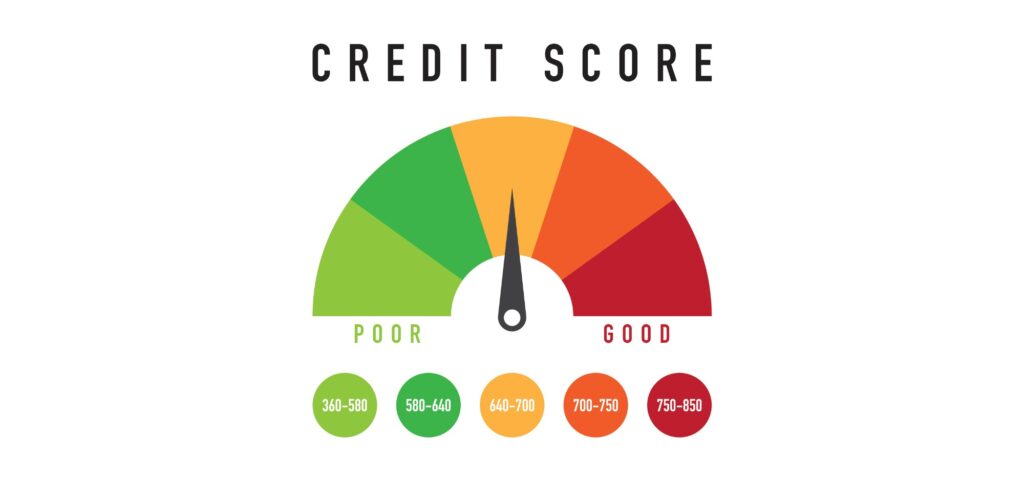

Credit score ranges vary based on the credit rating model used, but are generally similar to:

- 300-579: weak

- 580-669: just

- 670-739: Good

- 740-799: Very good

- 800-850: Excellent

There are many different scoring forms, and some use other data, such as your income, when calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as a factor when deciding whether to extend credit to you, such as a loan or credit card.

Why are credit scores important?

Why is it important to strive for the higher credit score? Simply put, those with higher credit scores generally get more favorable credit terms, which may translate into lower payments and lower interest payments over the life of the account.

Remember, however, that the financial and credit situation is different from one another. Different lenders may also have the different criteria when it comes to granting credit, which may include information such as your income.

The types of the credit scores used by lenders and creditors may vary based on their industry. For example, if you’re buying a car, an auto lender might use a credit score that focuses more on your payment history when it comes to auto loans.

What affects your credit score?

Common factors can affect all of your credit scores, and they are often broken down into five categories:

- Payment history: Making timely payments on your credit accounts can help drive your results. But not having payments, sending an account to collection groups, or filing for bankruptcy can hurt your results.

- Credit usage: How many of your accounts have balances, the amount you owe and the portion of the credit limit you use in revolving accounts all go here.

- Credit history length: This category includes the average age for all of your credit accounts, along with the age of your oldest and most recent accounts.

- Account types: Also called “credit mix,” this takes into account whether you manage installment accounts (such as a car loan, personal loan, or mortgage) and revolving accounts (such as credit cards and other types of credit lines). Showing that you can manage both types of accounts responsibly helps overall to achieve your results.

- Recent Activity: This takes into account whether you recently applied or opened new accounts.

Why are there different credit scores?

The credit scores are a tool that lenders use to make lending decisions. FICO® and VantageScore create different credit scoring models for lenders, and both companies release new versions of their credit score models periodically — similar to how other software companies might introduce new operating systems. Recent releases may incorporate technological developments or changes in consumer behaviour, or comply better with modern regulatory requirements.

For example, VantageScore creates a three-desk scoring form, which means the same form can evaluate your credit report from any of the three major consumer credit bureaus (Experian, TransUnion, and Equifax). The first version (VantageScore 1.0) was created in 2006. The latest version, VantageScore 4.0, was released in 2017 and was developed based on data from 2014 to 2016.

It was the first public credit score to incorporate rolling data—in other words, how consumers manage their accounts over time. the time.

FICO® is an older company, and was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring forms for use with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two common types of FICO® score for consumers:

FICO® Base Score: These scores are created for any type of lender to use, as they are intended to predict the likelihood of a consumer defaulting on any type of credit obligation. The base FICO® scores range from 300-850.

Industry-specific FICO® scores: FICO® generates automated scores and bank card scores specifically for auto lenders and card issuers. Industry scores are intended to predict a consumer’s likelihood of falling behind a specific account type, and scores range from 250 to 900.